It’s 2021, and most people have to pay taxes on cryptocurrencies, including traders in the US, UK, Canada, Australia, and more. Learn how to calculate crypto taxes and how to use a cryptocurrency tax calculator to manage them. You owe cryptocurrency taxes based on your capital gains or losses from digital asset holdings like bitcoin, NFTs, or airdrops and mining. You are taxed on the value of your cryptocurrency gains when you sell or exchange these assets.

- How to Calculate Crypto Taxes

- Cryptocurrency Tax Calculation Example in The US

- How to Work Out Your Crypto Taxes

- When Cryptocurrency Capital Gains are Only Taxed

- How to Calculate Crypto Taxes Using a Crypto Tax Calculator

- How Do I Avoid Capital Gains Taxes on Crypto?

How To Calculate Crypto Taxes

You’ll need to keep track of your tax lots to calculate your tax liability accurately. The cost basis (the amount you paid for the cryptocurrency when you first bought it), the time you held it, and the price at which you traded it away or sold it are all included in tax lots. This is handled automatically by cryptocurrency tax software, which uses your investment and trading history.

To keep track of your tax lots, you’ll need your transaction history. You’ll also need the following information for each sale or exchange:

- The value of the coin or token sold, as well as the currency in which it was sold

- Fiat value at the time of purchase

- Date of purchase

- Fiat value at the time of trade or sale

- Date of the auction

Keeping detailed records is essential Because trades are challenging to backfill and any missing cost basis increases your tax liability. You can backfill missing data from receipts and exchange transaction confirmation emails, but regularly backing up your information from exchanges is far more convenient. Keeping track of unusual circumstances, such as lost coins and initial coin offerings (ICOs), will aid you in filling out your tax forms.

Tax Perspectives

Most people will need to answer the following questions:

- How long have you held your Bitcoin or other cryptocurrencies from purchase to sale? If held for less than a year, any profit may be liable for short-term capital gain tax. If held for longer than a year, any profit may be liable for long-term capital gains tax.

- What are your tax filing status and taxable income? That will determine your tax bracket and the tax rate on any Bitcoin profits.

- What is your country’s tax rate? That will determine if you owe taxes.

Cryptocurrency Tax Calculation Example In The USA

You can begin calculating your capital gains and losses once you’ve compiled your entire transaction history. Let’s look at some examples of matching crypto trades to understand the calculation.

In chronological order: you bought bitcoin, traded short term for ETH, and then sold that ETH long term for fiat. Your capital gains tax will be calculated separately for short-term and long-term trades held for less than a year and more than a year, respectively.

- You paid $45,000 for 1 BTC (including fees), so your cost basis for this 1 BTC lot is $45,000.

- The next day, you sold this 1 BTC for $50,000 (including fees) in ETH, resulting in a $5,000 profit.

- Subtract the $45,000 cost basis from the $50,000 proceeds, and you’ll have a gain of $5,000, on which you’ll have to pay short-term capital gains tax.

- Then you sold the $50,000 in ETH for $60,000 (including fees) in dollars more than a year later, for a total profit of $10,000.

- Subtract the $50,000 cost from the $60,000 proceeds, and your gain is $10,000, on which you must pay long-term capital gains tax.

How To Work Out Your Crypto Taxes (USA)

Calculating crypto taxes requires matching crypto sales to their respective cost basis (the price paid for that crypto at the time of purchase) and then calculating the gain or loss from that sale.

However, selling a lot of cryptocurrencies gets a little trickier if you have multiple cost bases. For example, if you buy 1 ETH at $1000 and 1 ETH for $2,000 the following year, and then sell 1 ETH three years later for $5000 in 2021, what’s your cost basis?

In the example above, accounting methods such as FIFO, LIFO, and Minimization determine which cost basis is used. For example, FIFO (First in, first-out) would choose the earlier ETH purchase as the cost basis for that sale three years later.

Crypto’s divisible nature means that many sales will either need to choose from multiple cost bases, or a single sale can have multiple cost bases. An accounting method like the one described above will be required most of the time. In the latter case, a single line on the 8949 form would be split into multiple lines, each with its cost basis and gain/loss calculation.

Anyone selling or exchanging a capital asset, such as stock, real estate, or crypto in the United States, must complete the IRS Form 8949. You must use the form to record both short and long-term transactions.

If you only have a few crypto trades, manually calculating the gain and loss for each sale during the tax year and entering those on Form 8949 may be simple. However, if you traded on multiple exchanges, sold coins with different cost bases, and held positions for several years, a crypto tax calculator platform may be more convenient.

When Cryptocurrency Capital Gains Are Only Taxed

Gains on crypto (and property in general) do not become “realized” until the asset is sold, exchanged, or spent. This means that if you only bought BTC once and kept it, never selling or exchanging it, you’ll only have unrealized gains or losses, not realized, taxable gains or losses. You can only claim a loss if you sell a crypto asset you are holding at a loss.

It’s a good idea to keep track of your unrealized gains and losses. Many crypto traders, for example, were caught off guard when filing their 2017 and 2018 taxes because they may have exchanged their BTC for altcoins, resulting in a large gain at the end of 2017 due to the market’s peak.

Then, when the value of those altcoins dropped, they expected a loss when filing taxes, only to find out that they couldn’t claim the loss because they hadn’t sold the coins yet, and thus hadn’t realized the loss.

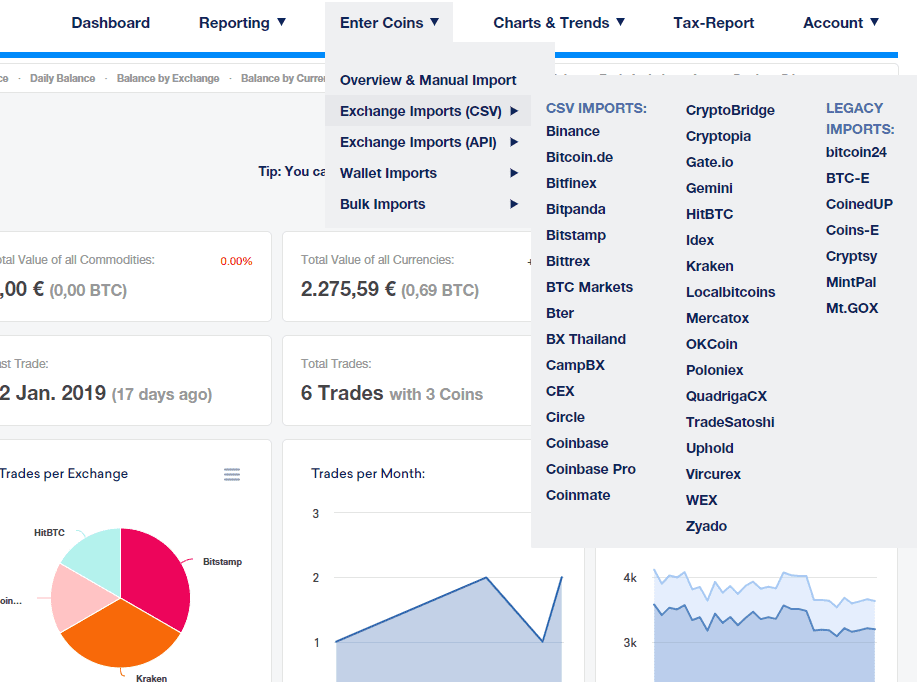

How To Calculate Crypto Taxes Using A Crypto Tax Calculator

Crypto tax calculators work by aggregating your data and then using accounting methods like FIFO or LIFO to link your cost bases to your sales automatically. They calculate your gains or losses and populate tax reports with your information automatically.

When using a bitcoin tax calculator, you’d go through the following steps:

- Import your entire cryptocurrency exchange trade history, as well as any off-exchange transactions.

- Check to see if all historical data has been imported and that your crypto taxes have been correctly calculated.

- Choose an accounting system.

- Export tax forms.

How Do I Avoid Capital Gains Taxes On Crypto?

Cryptocurrency is a capital asset or property, according to the United States IRS. So the same tax rules apply to cryptocurrency gains as to stock, rental property, and other passive investments.

Buying cryptocurrency inside an IRA, 401-k, defined benefit, or a retirement plan is the easiest way to avoid paying capital gains taxes on it. If you buy cryptocurrency in an IRA, you can defer your tax obligations until you start taking distributions. If you buy within a ROTH, the capital gains earned in the account are tax-free.

FAQ

How to calculate crypto taxes?

You’ll need to keep track of your tax lots to calculate your tax liability accurately. The cost basis (the amount you paid for the cryptocurrency when you first bought it), the time you held it, and the price at which you traded it away or sold it are all included in tax lots.

How to avoid capital gains taxes on crypto?

Cryptocurrency is a capital asset or property, according to the United States IRS. So the same tax rules apply to cryptocurrency gains as to stock, rental property, and other passive investments.