Ever get this inner urge inside of you when you start something new and are really excited about it? Now, picture a novice crypto investor who is about to make their first trade. What are they dreaming about?

Doubtlessly they’re dreaming of profiting from their very first trade, preferably a big win.

Right attitude

Indeed, the natural response of beginner traders is to sell winners immediately in order to lock profits. At the same time, they hang onto losers not only to avoid losses but also in the hope that the coin will eventually go up. Because it simply hurts to be wrong.

Nevertheless, this is quite a common situation well-described in the saying, famous in the trading world, to “hold winners for longer and sell losers faster”.

That is to say, you should keep in mind that trading, and cryptocurrency trading, in particular, is the field where all of your basic instincts are normally counterintuitive.

So be wiser than that and base your trading strategy on achieving gains over a long period of time rather than gaining profit from a single trade.

Approach cryptocurrency trading as you would with any career. It’s a time-consuming and stressful process that might last for years. You will win money. But you will also lose money. That’s a fact. And this is the reason why it’s advisable that you don’t invest an amount that will affect your livelihood, at least in the first year. Normally, 2% of your capital is the appropriate sum.

People who manage to get rich overnight, especially in 2017, were happy to share their stories online. But remember that there were also those who lost a lot of money when the hype had waned, and they, of course, didn’t report that.

This is the dark side to crypto trading. It’s a very lonely career not only because you have to spend day in and day out in front of the screen, but also because normally it’s very hard to share your losers with friends and family.

So prepare yourself mentally to walk this path alone, start with the trading plan, learn about some technical instruments and always have appropriate risk management strategy at hand.

Have a trading plan and follow it

The reason why you need to have a trading plan is exactly to cut losers. Sometimes you feel like you need to close or open a specific order. The weather is good, you feel lucky, the trend is going up.

But remember: trades that are not on your plan are not there for good reason. This is the non-anxious version of you asking you to stop and manage your risks before going crazy.

Create the plan in accordance with your trading style and account size, so you know when it’s time to bail out if the trade turned sour. Why bail out when you feel lucky? Because your journal told you so.

Basically, the objective is simple: to premeditate enough room for the price to wiggle in your favour before the trend starts moving against you, and to quit quickly when it happens. This will give you more time to look for other opportunities.

While plotting your crypto trading plan, keep in mind that entry and exit points, recorded in your journal in advance, are important to determine your levels on the upside and downside. Which slowly leads us to the question of how much you’re ready to risk.

That being said, the plan carefully written on a piece of paper in a calm state of mind will help you maintain discipline when your hair is on fire, which honestly happens quite often in the process of cryptocurrency trading.

Use stop-losses and trailing stop-losses

You can read more on stop-losses and trailing stop-losses in TradeSanta’s other pieces, but in its essence, this feature helps you get out of a losing trade when the coin reaches a certain level.

Say, you can risk maximum $50 on one Ethereum (ETH) that costs $189 at the time of press. That means you should set your stop-loss at $139. Once the coin drops this low, the order will be automatically closed, minimizing your losses.

But what if the price hits a new high at $240 and then falls back to $190? With stop-loss, the order will not be closed until the price’s level hits the mark of $139.

Although it would be nice to close the deal at this point, right? This is possible with trailing stop-loss.

While using trailing stop-loss, you manage your risks in a more flexible manner. Say, again, you enter the market at a price of $189 for one Ethereum (ETH).

While setting your trailing stop-loss at $50, you will exit at $139 if the price goes down but also you will have a chance to exit with a winner if the price suddenly goes through the roof, like in our previous example, and bounces from $50 back to $190.

The trailing stop-loss level gets recalculated every time a new high is achieved.

To put it all together, trailing stop-loss and stop-loss are substantial parts of your risk management strategy but they also teach you two other things: risk/reward ratio and how well you can assess and predict market movements.

Apply proper risk management

As you have probably guessed from the previous section, there are several tools in place that might help you calculate the risks involved in the trading process.

But let’s start with your goal. Your goal is quite simple. A single trade shouldn’t have any major impact on your account balance, even if the impact is positive – successful traders make steady returns.

It happens because they set realistic goals and maintain conservative strategy which includes several things.

First, you should trade in the direction of a trend, second, exit in a quick manner once you find clear evidence that the trade is bad. Yes, this might be a problem since it’s human nature to believe that the situation will get better when things go wrong.

It’s also helpful to avoid margin trading and be bullish on crypto that is fundamentally strong. Plus, you can downsize your positions and get a smaller percentage of each coin, which leads us to the next point, namely, the diversification of your portfolio.

You can avoid portfolio risks by adding assets that have low correlation with one another. For example, mix new altcoins with well-established stablecoins, mix it with a little bit of Bitcoin and some forked projects. Also, don’t forget about diversification based on growth rate, market cap and stage of maturity.

In addition to that, you can assess profit potential by using the technique called risk/reward ratio.

Down below we’ll discuss three most popular ways to use it.

Golden standard

All the books and websites on trading claim that the “golden” risk/reward ratio is 1:3, meaning that your reward from each trade should be 3X your risk. So, let’s take a closer look at how it works in practice.

The price difference between the entry point of the trade and the stop-loss value is your risk.

If you go long, buying Bitcoin at $8K and placing a stop-loss at $7,800, then the risk on the trade is $200 ($8K minus $7,800). Say your take-profit target is $9K, meaning the profit potential is $1K, $9K minus $8K.

In this case, the risk/reward ratio equals to 200/1000, or 1:5, which is not a golden standard of 1:3.

So, let’s try and tailor our situation to the golden standard. Again, we enter at $8K, but this time place a stop-loss at $7,700, which increases our risk to $300. Plus, we set our take-profit target at $8,900, meaning our reward is about to be $900.

It’s time to calculate the risk/reward ratio, and you’ve probably guessed that 300/900 equals 1:3.

Fractional approach

The 1:2, 1:3 and proportion types of this kind are not the only way to calculate your risk/reward ratio.

You can use another scheme, and if the resulting ratio is greater than 1.0, the risk is greater than the profit potential. If the ratio is less than 1.0, the profit potential is greater than the risk.

Let’s examine our previous example. We entered at $8K with the stop-loss being set at $7,700 and a take-profit target of $8,900.

To use the fractional approach, we need to divide risk by reward, in our case, 300/900, which makes 0.3. Bingo, the ratio is less than 1.0, meaning the profit potential is greater than the risk.

Visuals

In addition to the previous metrics, you can also use the visuals devised a long time ago for your convenience.

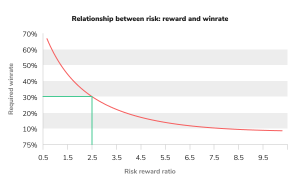

This chart and the table below represent the numbers so that you didn’t have to calculate your risk/reward ratio every time you enter a trade.

To use the chart, you should approach the calculation from a different perspective. Again, let’s use our example where we’re long Bitcoin.

We enter at $8K with a take-profit target of $8,900 while our stop-loss is adjusted to $7,700. So, again our risk is $300 all the same, and our reward is $900. But this time we need to divide our reward by risk, which equals to 3.

Now, take a look at the chart. With a risk/reward ratio that equals 3, your prediction should come true only 10% of the time. While gambling like this, you can lose 90% of the time on a regular basis and still make profits.

If it’s more convenient, have a look at other visuals, which basically mean the same.

At the end of the day, once you understand the connection between risk and reward, your life will become much easier. In other words, you’ll see that you don’t have to win all the time. Even if you win only 10% of your trades, you will turn a profit.

But beware of using the same strategy all the time. It’s rather more strategic to calculate risk/reward ratio for every individual strategy.

To sum up, these are all parts of a common approach, but there are two more important instruments to assess your risk and these are of course technical analysis and fundamental analysis.

You can read more on the core differences between these two analysis types in TradeSanta’s other piece. Herein, we will give you a short overview of each of those.

Consider technical analysis

Now, this is exactly the part that might take you a lot of time to learn how to implement. However, it’s inevitable for a seasoned trader to use technical analysis.

In technical analysis, there are very many indicators that might help you figure out exit and entry points, such as MACD, simple moving averages, parabolic SAR and many more that TradeSanta has already written about. Each of those indicators is worthy of many in-depth articles.

This overview, however, is the right place to say that many experienced traders combine several indicators they find especially helpful. Those charts provide you, for example, with sell signals and indicate when it’s time to get out of a losing trade. And you should learn how to utilize them in a proper way.

What about fundamental analysis?

The question as to whether or not you should use the fundamental analysis has always provoked heated debate in the trading community. But is it applicable in crypto trading?

Let’s see…

There are several specific things about fundamental analysis you should keep in mind. To assess a coin’s performance, traders who want to employ fundamental techniques would consider the economic environment of the coin, such as the financial performance of a project, its challengers and its business model.

For example, several nextgen altcoins, such as Telegram’s Gram Coin, fall into these metrics. You can find financial data on the Internet on the company’s revenue, user statistics and how much money they’ve raised in an ICO.

Regarding existing coins, you can also inspect CoinMarketCap and research a project’s capitalization, volume and circulating supply to evaluate the investment potential of a company.

Yet, because the fundamental analysis is based on an in-depth analysis of the industry, the economy and the company itself, to implement it in crypto might be not easy, since the industry is too young and not all projects are that transparent.

The best approach as of now would be to use the fundamental metrics where possible, and combine them with technical analysis.

Key takeaways

By now, you’re probably thinking to yourself, “Phew, that’s a lot to process”, and you’re right. For your convenience, here is a short checklist of things you should keep in mind.

First, treat trading as you would any career: it’s a long path of trials and tribulations. Also, keep your trading plan at hand to check if the anxious version of you behaves in a way you would in a calm state of mind.

Also, don’t forget about stop-losses which will slowly teach you to apply risk management instruments in your trading process.

Appropriate risk management itself is a concept that consists of several important things, but one of them is diversification of your portfolio.

Last but not least is, of course, fundamental analysis implemented where possible together with technical analysis that should be used all the time. Start learning all about the latter if you’re serious about trading.

To wrap it up, even when using all of these tools, you won’t only have winners, and that’s totally normal.

Remember to prepare yourself mentally to have lossess. You can’t control it. The only thing you can do is to try your best to minimize them.

FAQ

How to cut losses in crypto trading?

A few things are important to remember when cutting losses in crypto trading: right attitude, a trading plan, stop-losses and trailing stop-losses, proper risk-management tools.

What to do when crypto crashes?

Don’t forget about stop-losses which will slowly teach you to apply risk management instruments in your trading process.