Disclaimer: nothing in this article should be considered as investment advice. It’s opinionated and only representative of author’s views and experience.

Algorithmic trading has more than 40 years of history with its roots in 70s of the previous century on NYSE. Machines can work 24/7, have no emotions and are able to track market data for hundreds of trading pairs on several markets simultaneously. According to JPMorgan research, share of manual trading on traditional exchanges such as NYSE is only 10% of their total turnover. The rest is done by the algorithms. Cryptocurrency market will for sure follow this way, as most experienced traders and investfunds have their background in traditional assets.

While algo-trading is taking 90% in turnovers, vast majority of private traders are still using exchange terminals and trade manually. From its very beginning trading robots used to be very expensive, complicated to install and demanding for special technical knowledge to start with. They also required reliable server infrastructure. However, thanks to the cloud tech rise, more and more vendors start providing their algorithms as a service. Just Google “automated crypto trading” or check out Cryptohopper, 3commas and TradeSanta websites.

With such cloud software users only have to register online, set up their trading parameters through relatively friendly interface and launch the bot. Or 100 bots, if they like to. Connection between trader’s exchange account and cloud bot relies on API access feature, supported by all major exchanges. After setting up, crypto trading bots will work 24/7 following the rules set by user. Trading volumes increase dramatically, reportedly 20-50 times compared to manual trading. Profit opportunities may grow as well. Sounds like a jackpot, huh?

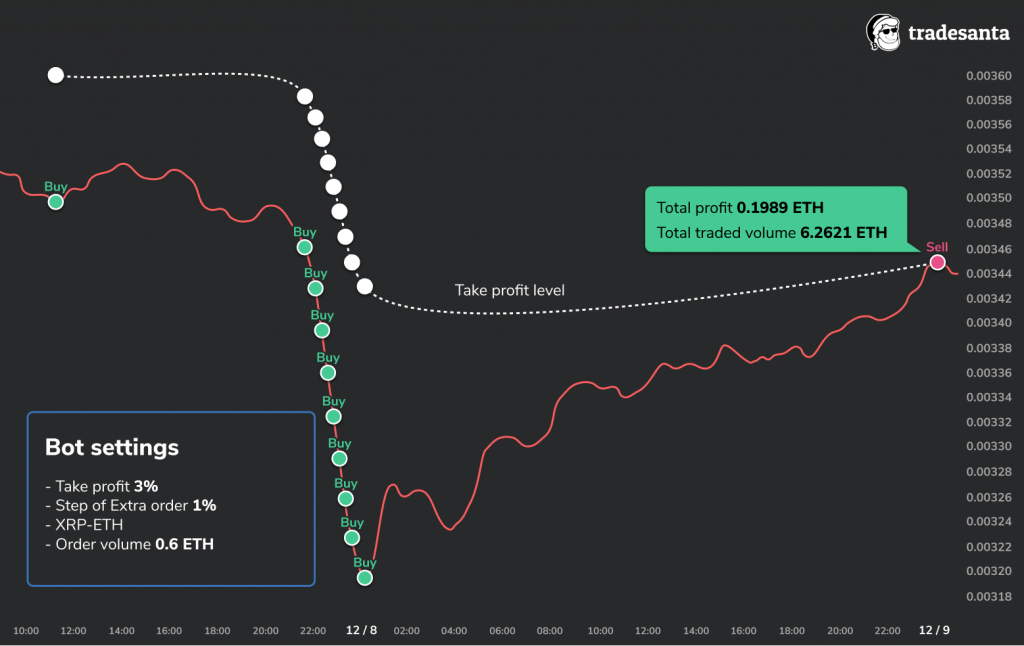

Successful cryptocurrency bot trade:

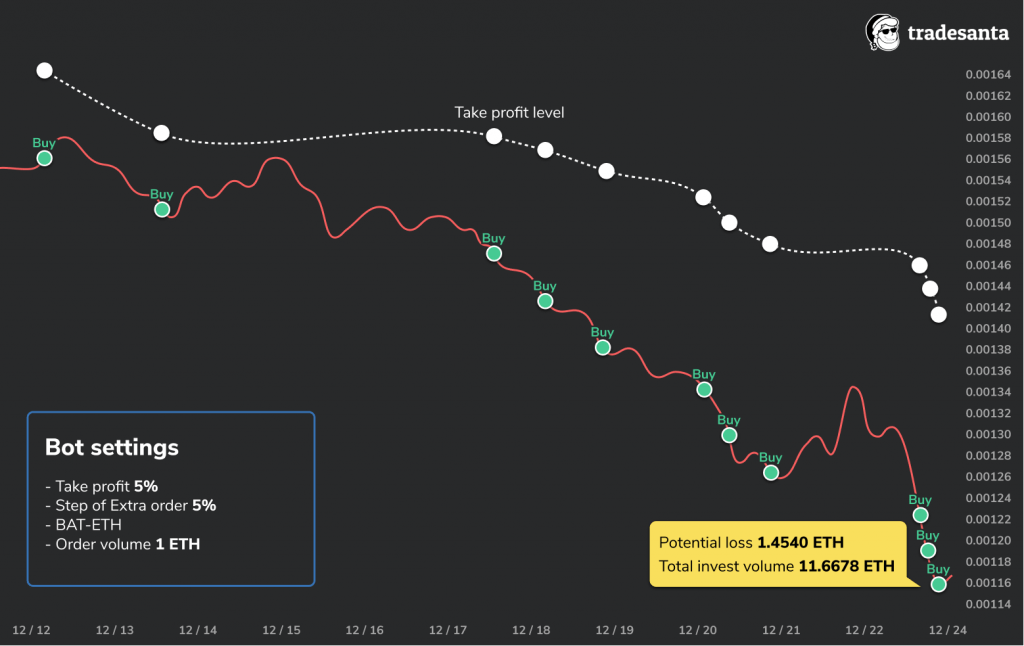

In real world new opportunities to earn more often come with the risks to lose more. Algorithmic trading has its own challenges that should be taken into account. For example – risk of bot account to be hacked and API keys stolen, wrong bot settings, error in algorithm that will generate losses instead of profits, sudden crypto market movements, etc. Traders may end up losing their funds or buying a large position in low-liquidity token.

Unsuccessful cryptocurrency bot trade:

Based on my trading experience with various crypto bots and platforms, there are few universal suggestions how to start using bots if you decide to try:

- NEVER trust “black box” bots who promise you income after depositing your crypto into their “smart contract”. Real bot will operate only through your account on well known cryptocurrency exchange. You should be able to see all trades and orders of your bot. Your API keys should NOT allow bot to make withdrawals from your exchange account. Permission to make trades is absolutely enough for all common strategies.

- ALWAYS cap your risk. Register new account on your exchange. Doing so you limit your worst-case losses to the amount, allocated in this account.

- Start small. Minimum order on most exchanges is roughly equal to $10 value. It’s enough to have 10-20 orders deposit value to try the crypto trading bot.

- Play safe. Trade only high volume pairs from Coinmarketcap. Let’s say, TOP-10 will be the wise choice. They have enough volatility to let bots do their job and enough liquidity to close your position if you’ll need it.

- Be conservative. Don’t try to catch every market movement setting low levels for bot triggers. Let’s say 1% to 5% should works well for the most beginners. It means that market price should move for at least 1% for your bot to make one trade.

If, despite all precautions (or because of ignoring them), you end up with your cryptocurrency bot buying too many coins during the sudden market decline, you may try one of the following:

- Fix your loss. Stop your bot, sell coins manually. Pro – you’ll immediately release your funds for a future trade. Contra – you’ll lose your option to recover this exact trade.

- Keep waiting. Probably, the market will hit your take profit order and the bot will finish its job successfully. Pro – you still have chances to earn from this trade. Contra – this may never happen, cryptocurrency market can go deeper and never recover, your assets are kept frozen in an unwanted deal.

- Launch another bot in the “opposite direction”, so it will sell purchased coins during market growth. This can be considered as a compromise between first two options. Probably the bot will not sell all coins with profit, but it can step-by-step reduce your position.

- Stop the bot, buy more position of your trade, reduce the average purchase price doing so. Then try to sell your position with profit on a lower level. This option is the most risky and is not recommended to anyone without proper trading experience.

Unlike traditional investors crypto hodlers can’t expect to get dividend payments from their portfolio. That is why automated trading can be an opportunity to get some profits from crypto market volatility without investing more into it. Cloud algorithmic trading is the growing trend, started in late 2017. It may be promising both for crypto holders who can earn more and cryptocurrency exchanges who can significantly increase their liquidity and volumes. But of course consider all the risks before trying!

FAQ

How to start using crypto bots?

NEVER trust “black box” bots who promise you income after depositing your crypto into their “smart contract”. ALWAYS cap your risk. Register new account on your exchange. Doing so you limit your worst-case losses to the amount, allocated in this account.

What should I do if my crypto bot bought too many coins durin the sudden market decline?

Fix your loss. Stop your bot, sell coins manually.

Keep waiting. Probably, the market will hit your take profit order and the bot will finish its job successfully.

Launch another bot in the “opposite direction”, so it will sell purchased coins during market growth.

When should you set up a stop-loss?

Unlike a limit order, which aims to profit from the current trends, a cryptocurrency trader will use a stop loss order to limit potential losses to no more than they are able to take on.